Welcome to Gift-nifty, your go-to destination for unlocking the secrets of financial markets and enhancing your trading prowess. In today’s fast-paced world of investments, staying ahead of the curve is not just an advantage; it’s a necessity. And that’s where the Supertrend Indicator comes into play. If you’re a seasoned trader or someone just starting on their financial journey, you’ve likely heard whispers of the Supertrend Indicator and its powerful impact on market analysis. In this comprehensive guide, we delve deep into the intricacies of the Supertrend Indicator, demystifying its explanation, unraveling its equation, and providing you with practical tactics to leverage its potential effectively.

Supertrend Indicator

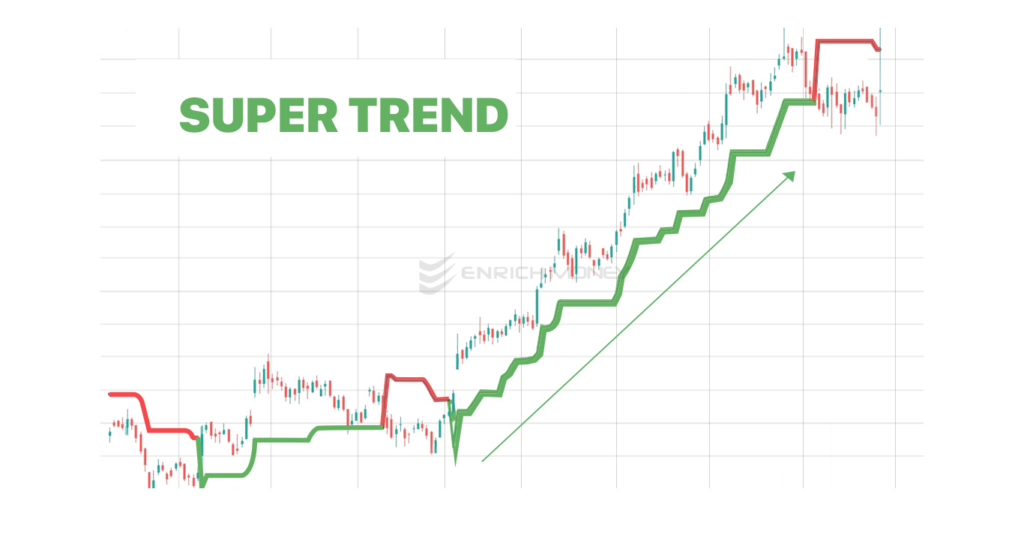

A technical tool for determining the direction of price movements in financial markets is the Supertrend Indicator. The Supertrend indicator appears as a line above or below the instrument’s price on a candlestick chart.

An uptrend is suggested by a green technical indicator line, and a downtrend is indicated by a red line. Based on the current trend direction, this clear visual depiction assists traders in making well-informed decisions regarding the purchase or sale of assets.

Key Takeaways

- The supertrend indicator aids in determining if the price movement of a financial instrument is following an uptrend or downturn.

- Through its Supertrend Upper and Lower Lines, it offers dynamic levels of support and resistance.

- When the price crosses the Supertrend lines, the indicator suggests possible entry points that might be used to buy or sell.

- The Supertrend Indicator is more sensitive to shifting price movements since it uses the Average True Range (ATR) to adjust to market volatility.

Supertrend Indicator Formula

The Supertrend indicator can be computed with ease by multiplying the average true range, high, and low values.

Supertrend Indicator Formula:

Average True Range (ATR):

- Calculate the True Range (TR) for each period:

- True Range (TR) = Max[(High – Low), |High – Close_prev|, |Low – Close_prev|] (where High is the highest price, Low is the lowest price, and Close_prev is the previous closing price)

- Calculate the Average True Range (ATR) over the specified period:

- ATR = (ATR_prev * (period – 1) + TR_current) / period

Multiplier Factor:

- This is a user-defined value, often denoted as “Multiplier.”

Supertrend (Upper) Line:

- Supertrend Upper Line = High + (Multiplier * ATR)

Supertrend (Lower) Line:

- Supertrend Lower Line = Low – (Multiplier * ATR)

The upper and lower lines of the supertrend indicator are produced by these computations, and they can be placed on a price chart to show trends and possible trading opportunities. Because it is based on the ATR, the Supertrend indicator adjusts to fluctuations in the market. The lines travel further away from the price during times of greater volatility, representing the larger possible price fluctuations. In contrast, during times of lesser volatility, the lines converge closer to the price, suggesting smaller possible price fluctuations.

How to Interpret Supertrend Indicator Signals?

You must be able to interpret Supertrend Indicator signals in order to make wise selections. This is how you can understand it:

1. Uptrend Signal (Buy Signal)

An upward trend is shown by the green line of the Supertrend Indicator. A purchase signal is generated when the closing price crosses this line. This indicates that now would be a good time to take a long position or hold onto an existing one.

The Supertrend’s turn green signals that the market is currently in a bullish mood, which is ideal for acquiring assets or extending long positions.

2. Downtrend Signal (Sell Signal)

A downward trend is indicated when the Supertrend line turns red. If the price closes below this red Supertrend line, it represents a sell signal.

With more price drops in the ongoing bearish trend, traders view this as a favorable time to enter a short (sell) position or to exit existing long holdings.

3. Counter-Trend Trading

It’s common knowledge that trading against the dominant Supertrend indication should be avoided. To put it another way, avoid buying when the Supertrend is visibly red, which denotes a decline, and selling when it is green, which indicates an uptrend.

For increased chances of success, it is normally advisable to line up your transactions with the direction of the Supertrend rather than against it. Trading against the signal increases the danger of losses. Nevertheless, a lot of traders employ Supertrend as a contrarian signal.

4. Reversal

For as long as the Supertrend indicator is intact, you should stay in the trade. This entails maintaining a position along the trend until a signal emerges that suggests a trend reversal or a change in the Supertrend color.

It is important to follow the indicator’s direction until conditions change because exiting a trade too soon might lead to lost profit possibilities.

5. Combine with Other Indicators

To validate trading indications, use the Supertrend Indicator with additional technical indicators such as Bollinger Bands, Moving Averages, and more.

Traders can decrease the likelihood of misleading signals by increasing their decision-making confidence by cross-referencing various indicators.

By using this method, the Supertrend Indicator performs better and traders are able to make more dependable and knowledgeable trading decisions.

Best Supertrend Indicator Settings

The ideal parameters for the Supertrend indicator can change based on the market you’re trading in and your trading style. Still, a typical place to start is:

- Period for Average True Range (ATR): 14

- Multiplier: 2.0

These Supertrend indicator settings are a good starting point for a lot of traders, but you may need to modify them depending on your strategy, time frame, and market volatility.

To determine which setting best suits your trading strategy, it is necessary to backtest a variety of configurations.

Supertrend Trading Strategy

Following these procedures might help you potentially increase your trading decisions when utilizing a Supertrend trading strategy:

1. Select the Right Time Frame

Start by deciding on a timeframe that corresponds with your trading objectives. While longer time frames, like daily or weekly, are better for swing trading or investing, shorter time frames, like 15 minutes, are appropriate for day trading.

2. Determine the Supertrend Parameters

Configure the Supertrend Indicator’s parameters. This involves defining the time frame for computing the multiplier and Average True Range (ATR). ATR with 14 periods and a multiplier of 2 are typical configurations.

3. Entry Points

When the price closes above the Supertrend line during an upward trend, you might want to consider establishing a long (buy) position. On the other hand, if you’re looking to take a short (sell) position, wait for the price to close below the Supertrend line during a downtrend.

4. Setting Stop-Loss and Take-Profit Levels

Put stop-loss orders above the Supertrend line for short positions and below it for long positions to control risk. Based on your risk-reward ratio and the state of the market, determine your take-profit levels.

5. Trailing Stops

Use of trailing stops may be beneficial to maximize profits. As the price goes in your favor, make adjustments to your following stop-loss order to lock in gains and leave room for potential further price increases.

Risk Management Using Supertrend

Using the Supertrend Indicator for risk management entails placing stop-loss orders in response to Supertrend alerts.

Set a stop-loss immediately below the Supertrend line for long positions and just above it for short positions.

By limiting possible losses in the event of a market reversal, this method makes sure that trades are closed before notable negative movements take place.

To safeguard profits, consider following stop-loss orders while the trend continues and adjust your position size to match your risk tolerance.

In volatile markets, using Supertrend for risk management aids in capital preservation and discipline.

Pros & Cons of Supertrend Indicator

The Supertrend Indicator’s benefits and drawbacks are summarized in the following table:

| Pros | Cons |

|---|---|

| Simple to understand and use | Lagging indicator, not predictive |

| Provides clear trend signals | Whipsaw during sideways markets |

| Helps identify entry and exit points | May generate false signals |

| Adaptable to various timeframes | Requires fine-tuning of parameters |

| Effective in trending markets | Does not account for the fundamentals |

| Works well with other indicators | Not suitable for all market types |

| Aids in risk management | Potential for missed big trends |

Conclusion

The Supertrend Indicator is an effective instrument that can improve your trading because it provides insightful data that helps with decision-making. It assists you in recognizing and taking advantage of a market trend.

But keep in mind that trading well calls for a trifecta of discipline, strategy, and expertise. Prior to utilizing any signal for trading, always conduct your own research.

Also Read- Forex Line Trading: Definition, Trends, Uses, Strategies, And Indicators