When you buy stocks, you need to keep an eye on how your investment is performing. If a business wants to get more owners, they may do a split stocks. A stock split is when a company’s shares are split into two or more shares.

In other words, The share price of some companies can get so high at times that it’s hard for buyers to buy even one stock. This is when most businesses split their stock.

What is Stock Split & How Does It Work

The face value of each share can be lowered through a stock split, which is a business move that makes the stock more liquid and affordable.

People who already own shares in the company are split into multiple shares, usually in a number like 1:2 or 2:3.

It raises the number of shares and lowers the price of each share, but the market capitalization stays the same as a whole. People often do a stock split when they think that the company’s shares are too “pricey.”

One example is Bajaj Finserv, which had a stock split in 2022 that was 1:5. In this way, each shareholder’s one share turned into five shares. Before the stock split, Bajaj Finserv was trading at Rs. 14,579.95 per share. Not long after the split, the share was worth Rs. 1,596.00.

In the same way, Tata Steel’s stock split in 2022 in a 1:10 ratio. People who bought shares got 10 shares for every share they bought. A short time before the split, Tata Steel was worth Rs. 1,534.60, but it is now only worth Rs. 124.25.

As you can see, a stock split lowers the price of each share, which makes the company more flexible.

Types Of Stock Splits

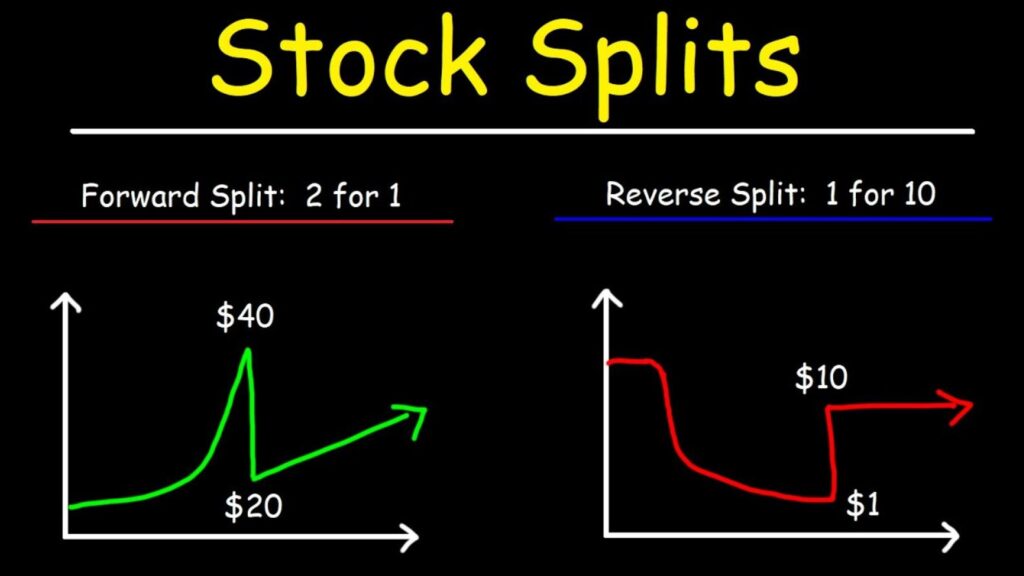

The kind of stock split is important because it shows how well a company is doing. A regular stock split could happen if a company thinks the price of the stock is too high. This could mean that the company is doing well and wants to get more people to invest in it.

Reverse stock split

When you buy regular stock, you split the number of shares you already own into more shares. A reverse stock split cuts down on the number of shares that were at one time very high. A business that was worth $10 a share is now worth $20 a share after a 1-2 reverse stock split. If you had 10 shares, you now only have five.

If the share price needs to go up and the company doesn’t want to be delisted because of a low share price, a reverse stock split might be done.

2/1 stock split

A common stock split is when a single share is split in half. Let’s say you own 50 shares of a stock that are each worth $50. A 2/1 split will give you 100 shares that are each worth $25. Most of the time, this is how stock splits work.

3/1 stock split

When a company splits a share of stock three ways instead of two, this is called a 3/1 stock split. That is, if you have 100 shares of stock worth $30 each, you will now have 300 shares worth $10 each.

Why Do Companies Go For Split Stocks

When a company thinks that the share price is too high for most people, they may split their stocks. By splitting the stocks and lowering the price per share, they’re letting more people who want to invest in the company.

A reverse stock split could mean that things are going badly for a company. So, the price of the stock goes back up, and there are fewer shares for people to buy.

What are the pros and cons of stock splits?

Pros.

- There are more chances to buy. A stock split can make it easier for people who want to invest to buy more shares because the price of each share drops. It’s easier for people to buy that wouldn’t have been able to before.

- Make people more aware. A company that wasn’t getting much attention before the news of the stock split might get more of it now.

Cons.

- Could get unstable. Stock splits can make the market more volatile because some buyers sell their shares and others buy them. When you’re investing for the long term, it’s important to keep this in mind as part of the danger.

- Doesn’t raise the value. Getting more shares doesn’t mean that those shares are worth more. But if you plan to hold on to it for a while, more buyers could buy shares and raise the value.

Good News | Now you can track live Gift-Nifty Chart here on our website.

Examples of Stock Split Events

Here are some examples of stock splits that have happened in the past:

- In November 2016, Karur Vysya Bank split its stock. In 2016, the company changed the value of each share from ₹10 to ₹2.

- In October 2021, IRCTC had a stock split. There was a 1:5 stock split. The value of each IRCTC share dropped from ₹10 to ₧2 because of this.

- In August 2021, Global Textiles split its stock. The split made the company worth only ₹2 instead of ₹10.

- In July 2021, Tide Water Oil Company split its shares. Because of the split, each share was worth only ₹2 instead of ₹5.

Wrapping Up

You can cut a pizza in any way you want, but it’s still pizza. Similarly, a stock split doesn’t change how a company works.

But that’s the end of the comparison. Split Stocks often boost demand, either because they make the stock easier to get or because fund managers want to buy it. This is called the “signaling effect.”

In general, stock splits are good for the market—at least in the short term. However, the worth of each share will depend on how well the company does over time. If you want to buy a stock that’s about to split, you should think about the general health and growth prospects of the company as well as whether it fits with your investment goals.

Most Commonly Asked FAQs

You’ll pay more per share for a company before it splits than after it splits. If you want to get a better deal on a stock, you might want to wait until after the company split.

A stock split helps both companies that want to get more owners and people who want to invest in their business.

Sure, every purchase has some risk, but some have a lot more. If you want to buy stock, you may be taking on more risk than with index and mutual funds, for example.