Hi there! Today on Gift-Nifty, we will be talking about SIP in Mutual Funds. You need to know how to regularly put away small amounts of money so that your money grows over time to understand SIP in Mutual Funds. This guide will show you how SIPs work and why they might be a good choice for your money.

SIP in Mutual Fund

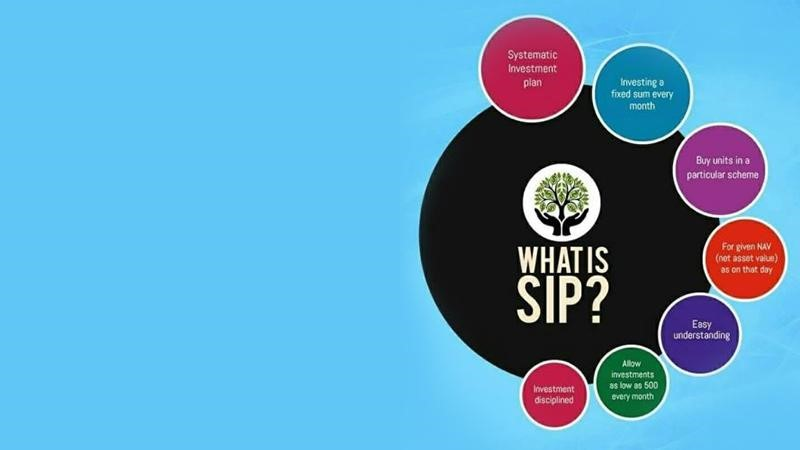

SIP stands for Systematic Investment Plan. It is a regular way to invest in various types of mutual funds. You can make it so that every month a certain amount of money goes into a mutual fund on its own.

For example, if you use a SIP to invest in mutual funds, you can always stick to your investment plan.

Normal checks can happen once a week, every three months, or even every six months. It’s up to you. An OTM (One Time Mandate) can be set up to take money out of your bank account every month once it’s been set up.

After you make the payment, it is put into the mutual fund of your choice. Plan units are then paid out based on the day-end Net Asset Value (NAV) of the mutual fund.

Your SIP can begin or end at any time. You can also stop your SIP if you don’t have enough money.

SIP Benefits

Explore the benefits of SIP and how they can make investing simpler and more rewarding for you!

Investing with Discipline

SIP helps people make smart, regular investments. Regularly putting away a set amount of money, like once a month, will help you get into the habit of spending it on things you want. This method keeps you from making hasty business decisions based on market changes that will only last for a short time.

Flexibility and Affordability

With SIP, you have more freedom because you can spend any amount of money. As your funds allow, you could start with a small payment and slowly raise it. Anyone with any amount of money can easily get into the stock market this way.

Professional Management of Funds

Professional fund managers are in charge of the money that is invested in SIP. These managers know how to do market research, choose investments, and handle portfolios. You can have someone else take care of your portfolio if you don’t have the time or skills to do it yourself.

Cost Averaging in Rupee

Rupee cost averaging is a big part of how safe SIPs are. Mutual Fund units are bought more when markets are low and fewer when markets are high. This is because the amount spent is set ahead of time.

The name of this method is rupee cost averaging. ” Changes in the market and the risk of trying to time the market are lessened by this method.

Diversification

With SIP, you can move your money between different mutual funds or groups of assets.

Some people think that putting all of their money into one buy is riskier than putting money into several funds.

Trends in SIP Mutual Funds

People in the country are learning more about concepts like “passive income” and “financial freedom,” which is making owners more serious about their goals.

I think you already guessed that SIP mutual funds are a good choice. It got to Rs 50 trillion in December 2023, which is when mutual funds started using it for the first time.

Ten years ago, that much money was only Rs 7 trillion. This huge rise is great news, and SIPs have played a big role in it.

Plans for investing money in stocks over time were the best choice, as they brought in Rs. 10 trillion through SIPs by the end of 2023.

Is SIP Safe for Mutual Funds Investors?

Several things can make or break SIP safety. You take steps to keep your money safe, so your SIPs are safe. Still, some risks come with buying into any mutual fund, such as the ones below:

Market Risk

For SIPs, changes in the market can be dangerous because the money is spread out among many different types of investments, such as stocks and bonds, by mutual funds.

How well these base assets do is affected by how volatile the market is.

But investing regularly and on purpose with SIPs, which is based on the idea of rupee cost averaging, makes short-term market moves less of a problem.

Economic and Market Conditions

Things like interest rates, inflation, world events, and economic policies can all affect how well mutual funds do.

Keep up with economic trends and market conditions to make better decisions about your SIP purchases. You may not be able to change these outside factors.

Investment Horizon

You should only use SIPs if you want to spend for a long time. If the market moves quickly, you could lose money. But because SIPs are long-term, they help you through these ups and downs.

In the past, the stock market has gone up for long periods. You might also do well if you invest for the long run with SIPs.

Liquidity

SIP There are times when mutual funds could be a financial risk. This term refers to how simple it is to buy and sell a house on the market.

Most of the time, it’s easy to get your money out of mutual funds. However, some stocks in the fund’s portfolio might not be. Professional fund management and government control, on the other hand, deal with and lessen these risks.

You should know your financial goals and how much risk you are ready to take before you start SIPs. This will help you make sure that your investments are safe and make you money. You should also promise to keep looking at your plan and making changes to it.

Conclusion

Mutual fund Setting up a SIP is a lot like setting up a regular savings plan where you save a set amount of money at set times. This means that your money will slowly grow over time. It’s like planting seeds that grow into fruit trees. Everyone can benefit from SIPs because they help investors stay disciplined while spending and give investors the freedom to choose how much to put in. By putting the costs of purchases over time, SIPs help even out changes in the market.

But you should know the risks that come with changing markets and have a plan for investing in the long run. SIPs can help you meet your financial goals and get rich over time if you understand them well and stick to them.

FAQs

How does SIP work in mutual funds?

SIP involves investing a fixed amount of money at regular intervals into mutual funds to build a portfolio gradually.

What are the benefits of SIPs?

SIPs offer disciplined investing, flexibility in contribution amounts, professional fund management, rupee cost averaging, and diversification of investments.

Are SIPs safe for mutual fund investors?

While generally safe, SIPs are not immune to market risks; factors like volatility, economic conditions, investment horizon, and liquidity can affect their performance.

How can I start a SIP?

You can start an SIP by selecting a mutual fund scheme, setting up automatic deductions from your bank account, and letting professional fund managers handle your investments.