Today, the benchmark Nifty hits a new peak by breaking through the 21,000 mark for the first time ever. In intraday trade, the Nifty index increased by as much as 105 points, setting a new high of 21,006.10. On December 7, the previous session finished with a value of 20,901.15. In the meantime, the Sensex gained about 367 points today to reach a record high of 69,888.33 in intraday trading.

All things considered, the Monetary Policy Committee’s (MPC) ruling seems to be in the best interests of the equity markets, giving the already skyrocketing shares even more momentum.

The Reserve Bank of India (RBI) increased its prediction for FY24 GDP to 7% from 6.5 percent and maintained the repo rate at 6.5 percent as anticipated. It did, however, maintain the 5.4 percent CPI inflation estimate for FY24. The central bank’s MPC also stuck to its guns, concentrating on “withdrawal of accommodation.”

This is the fifth session in which the Nifty has reached a record high in December.

In addition to today’s policy announcement, the index reached its highest point due to supportive global market trends, steady inflows of foreign capital, robust macro data, and a decline in the price of crude oil.

The index has already increased by more than 4% so far in December, and it has only had one session this month where returns have been negative. This follows a 5.5% increase in November. In the last year, the index has increased by over 13 percent, while overall in 2023 YTD, it has gained by nearly 15 percent.

Expert’s Note

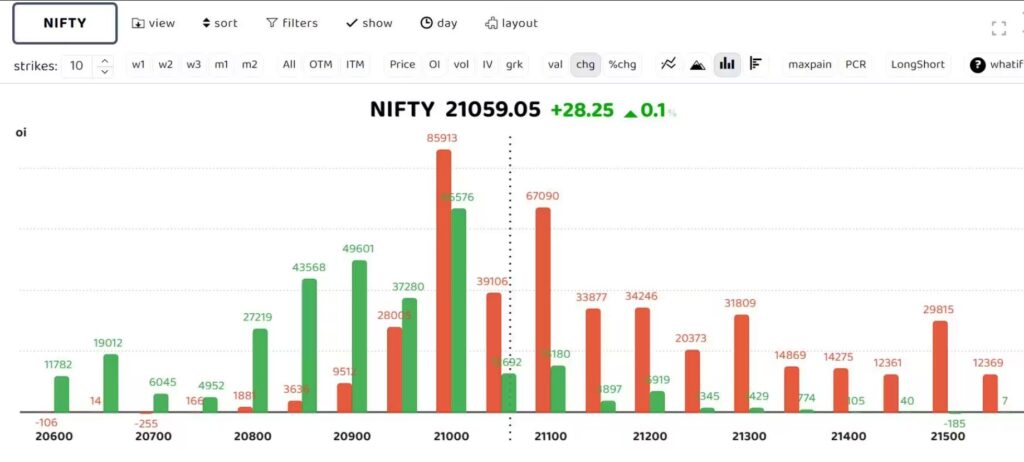

The market is expected to benefit from the upward revision of the real GDP growth estimate for 2023–2024. The Nifty may see volatility shortly; only a strong breakout over 21,000 might push the index into the 21,550–21,700 region. 20,800 is supposed to be a crucial support level, according to Rupak De, Senior Technical Analyst at LKP Securities.

Santosh Meena, Head of Research at Swastika Investment, provides a fundamental analysis and predicts that the Indian market will likely maintain its positive momentum, with the Nifty hits a new Peak of 21000.

“We think this trend(as we have seen Nifty hits a new Peak) will continue, perhaps with some consolidation en route. A special case for outperforming equities can be made for banking and financial stocks, considering their current valuations and structural advantages. In the medium run, Meena said, Nifty might move toward 21,275/21,500 and Bank Nifty might surpass 48,800/50,000.

Experts predict that going forward, the stock market will likely see a consistent upward trend, supported by solid economic data and a stable political climate. The 2024 elections and the approaching earnings season will now be the main drivers of the markets in the foreseeable future.

RBI Relaxations Might Take time

It’s crucial to remember that the RBI has not in any way hinted that repo rates will be relaxed.

“Despite the significant increase in interest rates, the economy is doing well, and the RBI does not believe that a course change is necessary. The RBI will be complacent in the face of such statistics and will be concentrating on the medium-term picture, even though inflation is predicted to gradually increase in the short term due to rising food costs. In the medium run, we anticipate 7% growth in FY24 and FY25, provided that inflation stays below the 6% threshold.

All things considered, this is a really positive remark. India, as an anomaly, is in the most comfortable position possible when other economies are thinking about reversing policy rates because their economy is slowing down, according to Sreeram Ramdas, Vice President, Green Portfolio PMS.

Related Read: LIC Shares At 52 Weeks High!

Chief Investment Officer of Bajaj Allianz Life Insurance Sampath Reddy further pointed out that steering the Indian economy through the difficult international climate will depend on the RBI’s attention on preserving stability and securing inflation expectations. Reddy is still expecting a protracted pause and thinks that the RBI’s future measures would rely on changing facts.

The CEO of InCred Money, Vijay Kuppa, added that the RBI has a disinflationary stance and is quite clear about it. Only in Q2FY24 will the headline CPI drop to 4%, according to RBI predictions. Before the RBI considers lowering rates, inflation must consistently hover around 4%. Any rate reduction before Q3FY24 appears improbable considering this.

Where Should You Invest? Experts’ Advice

Anirudh Garg, Founder, Fund Manager at Invasset, PMS

An atmosphere of stability is created for investors by the decision to keep the policy repo rate in place and to keep inflation targeting front and center. The solid economic foundations and GDP growth of India, along with this stability, should encourage investor confidence. A stable interest rate environment helps with improved margin management, which may be advantageous to the banking industry. The increased UPI transaction limits may also benefit industries like healthcare and education. Nonetheless, cautious investment in industries highly dependent on raw material pricing may be necessary given the focus on controlling inflation and potential supply-side shocks.

Anil Rego, the founder and fund manager of Right Horizons, said that the markets have reached all-time highs, especially now that the trajectory is being supported by strong H1FY24 profits. Because they anticipate rate cuts in 2024, which would undoubtedly strengthen the equities markets, investors are optimistic. Due to its robust and sustained loan expansion and its sensitivity to changes in interest rate cycles, the banking industry has been a major contributor to the incremental earnings seen in FY23 and FY24’s first half. Long-term rate reductions will eventually cause the NIM to shrink, but since we anticipate rate reductions to start in the most recent quarter, the banking sector’s trend is probably going to continue in FY24. The best-positioned NBFCs to gain from rate reductions will be those whose loan growth improves first, followed by banks. There will also be increased demand in credit-sensitive industries like real estate and autos.

Track Latest Nifty Trends here.