Welcome to gift-nifty, your go-to resource for mastering the intricate art of Forex line trading. In the fast-paced world of financial markets, Forex trading stands as a beacon of opportunity, offering individuals a gateway to engage in global currency exchange. This comprehensive guide aims to unravel the complexities of Forex line trading, an indispensable strategy utilized by traders worldwide. From understanding the core principles to implementing effective techniques, this guide is designed to equip both beginners and seasoned traders with the knowledge and tools necessary to navigate the dynamic landscape of Forex trading.

What is Forex Line Trading?

Forex line trading is a fundamental strategy employed by traders in the foreign exchange (Forex) market to analyze price movements and make informed trading decisions. This approach relies on the use of graphical representations, primarily lines and technical indicators, to interpret market trends and identify potential entry and exit points for currency trades.

Key Components of Forex Line Trading

- Trendlines: These are instrumental in depicting the direction of the market. An uptrend is illustrated by connecting successive higher lows, while a downtrend is formed by connecting lower highs. Trendlines help traders identify potential entry points aligned with the prevailing market direction.

- Support and Resistance Levels: These levels highlight key price points where a currency pair might reverse its direction. Support acts as a floor preventing further downward movement, while resistance acts as a ceiling hindering upward price movement. Identifying these levels assists traders in making decisions regarding stop-loss orders and profit targets.

- Moving Averages: Whether using simple moving averages (SMA) or exponential moving averages (EMA), these indicators smooth out price fluctuations, revealing underlying trends. They are pivotal in identifying the market trend and potential reversals.

- Other Technical Indicators: Indicators like Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands complement line trading strategies, providing additional insights into market conditions, momentum, and volatility.

Different Types Of Trends in Forex Line Trading

Trendlines are essential for locating and evaluating the appropriate asset price trends when doing technical analysis. In addition to enabling traders to make educated trading decisions, these useful tools also enable traders to determine the direction of the market. The following lists the many trend trading strategies that investors consistently employ with an options trading software to improve their decision-making:

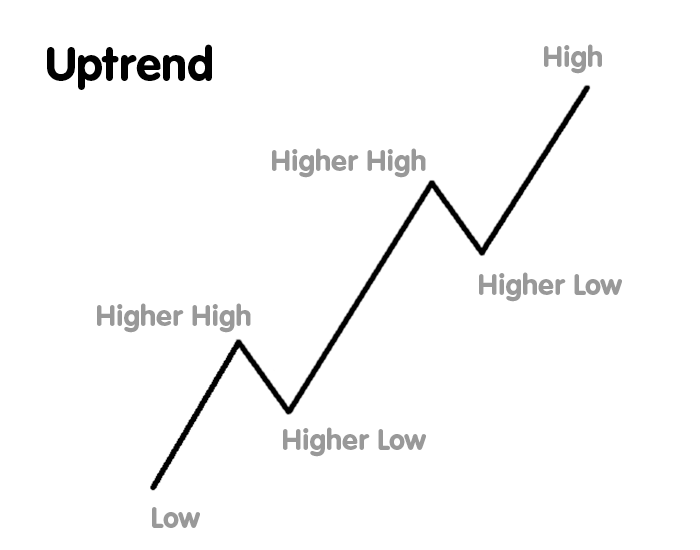

Uptrend (Higher Lows)

An uptrend occurs when the price of a trade asset steadily increases over time. In this case, every following low indicates more buying pressure and typically surpasses the preceding low. By joining higher swing lows, traders may create an upward-sloping trendline in this manner. This specific trendline serves as an excellent level of support.

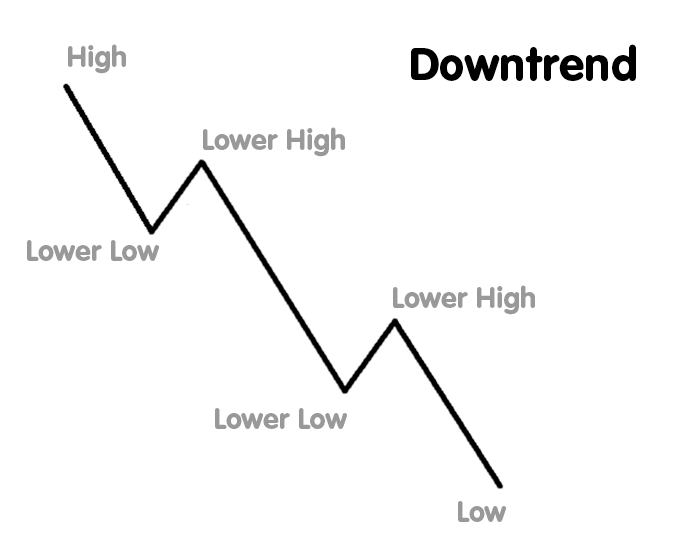

Downtrend (Lower Highs)

When an asset is in a downtrend, its price gradually drops. In addition to highlighting the increasing selling pressure, this trend is typically characterized by lower highs and lower lows. Additionally, traders create a downward-sloping trendline that is advanced by connecting the lower swing highs. This trendline, which functions as a great level of resistance, displays the assets’ downward trajectory.

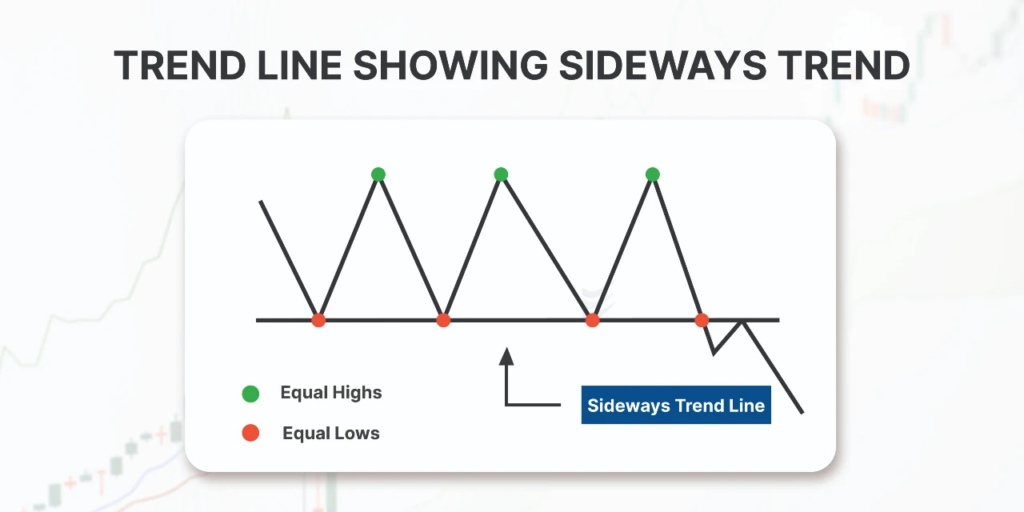

Sideways Trend (Ranging)

A sideways trend refers to the ranging or consolidating trend. It occurs when an asset’s price moves between a horizontal range. During this phase, the price also fails to establish significant higher or lower lows. Also, traders can easily employ the horizontal trendlines besides identifying this range’s upper and lower boundaries. These trendlines give complete support and show the resistance levels with clear insights about the potential areas; here, the price might rebound or reverse.

Tips for Forex Line Trading

Making decisions in forex line trading necessitates meticulous and in-depth investigation. Here’s where using a Forex Algo Trading App may assist. This section contains some excellent advice to help you successfully navigate the currency market:

Verify The Trend Across Several Timeframes

Analyze the trend in different time frames. It provides a more comprehensive and advanced view of the market. It also allows you to identify the overarching trend besides getting caught in short-term fluctuations. In the case of Higher time frames, for example – the daily or weekly charts always offer a clearer perspective on the ideal market direction and assist more reliable trend lines.

Discover How to Sketch Trend Lines

The price chart’s obvious swing highs and lows must also be the first thing you look for. The trend line can touch as many swing points as feasible without slicing through the candlestick bodies if these points are connected by a straight line.

Use Effective Risk Management

It is essential to safeguard your trading money by drafting suitable and optimal stop-loss orders. Additionally, you may equally position them above resistance levels during downtrends and below support levels during uptrends.The distance between the entry point and the stop-loss level should also be taken into account when determining the position size. This manner, in addition to making sure you don’t expose yourself to severe losses, you may anticipate maintaining a good risk reward.

How To Use Trend Lines in Forex?

Finding the optimal price trend is a simple process when using trend lines in forex. In addition to verifying the trend line, you can also build the trend line by joining the higher lows or lower highers. Here, an algorithmic trading program directs you. Lastly, you may use these trend lines to help you make better selections.

1. Identify The Trend

It is easy to determine the asset’s correct trend direction prior to constructing a trend line. One approach to accomplish this is to examine the chart and see if the price is trending upward, downward, or in a different direction.

2. Draw The Trend Line

Once you identify the right trend, you can easily draw the trend line and connect the peaks or troughs of the proper price movements. In an uptrend, you can connect the higher lows, and in a downtrend, you can connect the lower highs.

3. Validate The Trend Line

You may quickly confirm the trend line by checking once you’ve drawn it. When there is an uptrend, the price bounces off the trend line and keeps moving higher. In contrast, a downtrend occurs when the price bounces off the trend line and keeps down. You may be able to discern a shift in the trend direction after the price breaks through the trend line.

4. Make Better Trading Decisions With The Trend Line

For the best trades, the trend lines provide the precise and outstanding probable entry and exit positions. When the price is getting closer to the trend line during an upswing, a trader searches for various buying chances. Conversely, a trader searches for various selling opportunities during a decline. They even understand various stop-loss thresholds to minimize their losses in the event that the trend veers off course.

Best Forex Trading Strategies

Applying the finest forex trading tactics will eventually enable you to identify the sort of trader you are. You may do this with the use of an options trading app. You should be aware that certain currency trading techniques are more popular than others and that they may be tailored to the demands of specific traders. A few of them are –

1. Trend Trading Strategy

The trend trading method is regarded as one of the most often used and straightforward tactics. The sole need in this case is that you be able to trade in the direction of the market’s present movement.

If you want to be successful with this forex trading method, you can quickly determine the direction of the current trend. Additionally, it is simple to keep examining the currency market and obtain guidance on when to remove your position in the event that the market reverses.

2. Range Trading Forex Strategy

The range trading forex technique is based on the idea of support and resistance lines. Using the indications, it is regarded as a very good price action method that determines the optimal levels at which the currency market moves. These market lows and highs when put together can form a range.

3. News Trading Forex Strategy

There are always a lot of macroeconomic events and variables that affect the currency market. The many on-set happenings are the main emphasis of these news trading tactics. The data releases and interest rate announcements are relevant in this case. Compared to the smaller incidents, they are also easier to forecast and more dependable.

Conclusion

Forex line trading serves as a foundational approach for traders to comprehend market movements and make informed decisions. However, it’s imperative to acknowledge that no strategy guarantees success in trading. Continuous learning, adaptability to changing market conditions, and disciplined execution are key factors contributing to a trader’s success.

Aspiring Forex traders are encouraged to practice line trading strategies on demo accounts, honing their skills before transitioning to live trading. Remember, patience, consistency, and a commitment to learning are essential on the journey to mastering Forex line trading.