On Thursday, the first tranche of the SGB 2015-I sovereign gold bond is scheduled to be redeemed. With this one good question arises; which one is better b/w SGB Vs Sensex?

SGB

SGB stands for Sovereign Gold Bond. SGBs are government securities that are denominated in grams of gold. They are issued by the Reserve Bank of India on behalf of the Government of India.

With 20% of interest income earned during the last eight years included in the returns, the total throughout that time is 148%. Although it offers greater tax benefits, this is slightly less than the BSE Sensex’s 152% returns during this period.

What’s More On News:

The benefits for investors from the exemption of long-term capital gains (LTCG) tax for keeping it for the eight-year maturity period are not included in the narrative. Equity investors would otherwise pay 10% of their income in LTCG over Rs. 1 lakh if they decide to book profits on the redemption day.

168 stocks have produced multi-bagger returns over this time, according to an ETMarkets analysis of the stocks with a market capitalization of more than Rs 10,000 crore. Out of all of them, just nineteen stocks have returned less than gold bonds.

The interest income is computed at 2.5% per year over the issue price for the eight-year maturity period, even though the Reserve Bank of India (RBI) has fixed the redemption price at Rs 6,132 per gram, which is a 128% (Rs 3,448) premium over the issue price of Rs 2,684 per gram.

Launched on November 5, 2015, the first tranche of the SGB was available for subscription until November 20, 2015. The publication date was November 30, 2015. On June 13, 2016, the SGB was listed on the NSE, and one gram of gold was valued at Rs 2,686.

Sensex closed at 26,145.67 on the day of the SGB 2015-I’s issue, whereas it finished at 26,396.77 on the SGB’s listing date. As of Friday, November 24, 2023, its returns were close to 150%.

SGB Vs Sensex Stocks

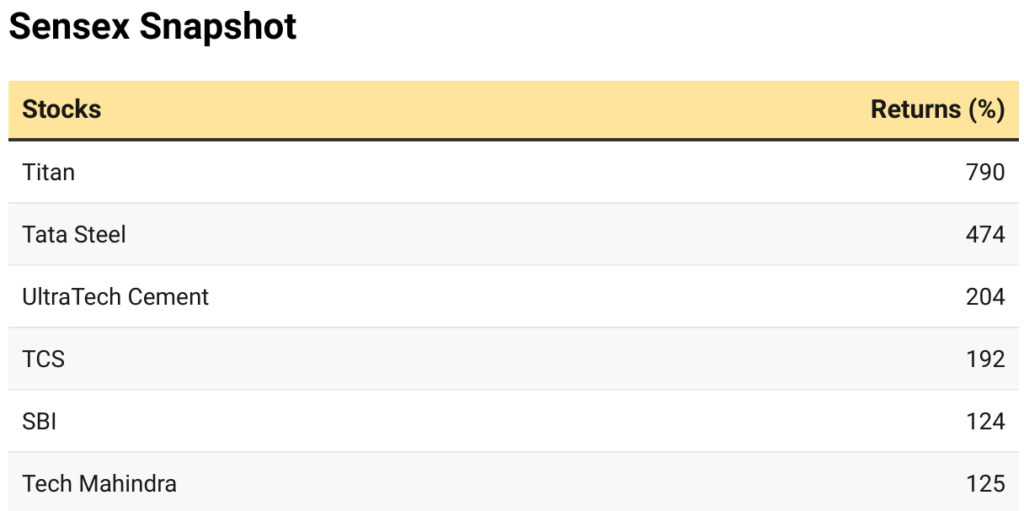

SGBs have lost ground to Tata counters among Sensex stocks. Titan has the highest returns of any company, coming in at 790%. Tata Steel, UltraTech Cement, Tata Consultancy Services, and State Bank of India are next, with 474%, 204.44%, and 125%, respectively.

While UPL (101%) has underperformed, Tata Consumer Products (573%)—a Nifty participant and non-Sensex company—has beaten SGB.

Historically, when we compare SGB vs Sensex, equities have outperformed other asset classes like gold in terms of prospective returns over long periods, but they also carry higher risks and volatility. Chief Executive Officer of Bankbazaar.com Adhil Shetty issued a warning, noting that past success does not guarantee future outcomes. He went on to say that while SGBs are a more reliable and secure investment than stocks, they might not have the same growth potential.

Experts’ Advice On SGB Vs Sensex

According to Shetty, while gold is a hedge against inflationary pressures and may not be very popular during economic uptrends, the performance of the Sensex is dependent on several factors, including corporate earnings, government policies, investor sentiment, global market conditions, and overall economic growth.

He said the choice to hold or redeem the SGB hinged on several factors when deciding whether or not investors should register profits. Determine if your investment objectives are in line with SGBs’ present performance. Think about your risk tolerance and whether you want to protect yourself from market volatility or pursue capital appreciation,” he advised.

When deciding whether to redeem the SGB, the BankBazaar expert stated that it is critical to take into account the state of the market, the forecast for gold, and the movements in interest rates.

Booking profit is advised, though, by knowledgeable Anuj Gupta, Head of Commodities & Currency at HDFC Securities. Although gold is at a six-month high and is expected to rise further, according to Gupta, owning the SGB carries a risk of profit erosion should gold prices decline due to unanticipated events. He went on to say that investors ought to use their profits to buy more gold or any other kind of asset.

Stocks Stats of Other Known Industries

Sanmit Infra, Waaree Renewable Technologies, Shivalik Bimetal Controls, Satia Industries, Tips Industries, and Tanfac Industries are the six lesser-known stocks that have produced the largest gains, ranging from 13,116% to 5,660%.

23 stocks had gains ranging from 3,179% to 1,008%, according to the research, while 39 stocks had returns exceeding 500% but falling short of 1,000%. In addition, 89 stocks yielded 500% returns.

The majority of the publicly traded Tata Group companies—Trent, Tinplate Company Of India, Tata Elxsi, Tata Investment Corporation, Tata Metaliks, Tata Chemicals, Tata Power Company, and Tata Teleservices (Maharashtra)—have produced multi-bagger returns ranging from 1,555% to 128%.

Among the 168 multi-bagger stocks, Suzlon Energy, UPL, The Great Eastern Shipping Company, Tata Steel Long Products, and Sical Logistics are from the broader markets and have underperformed SGB 2015-I.