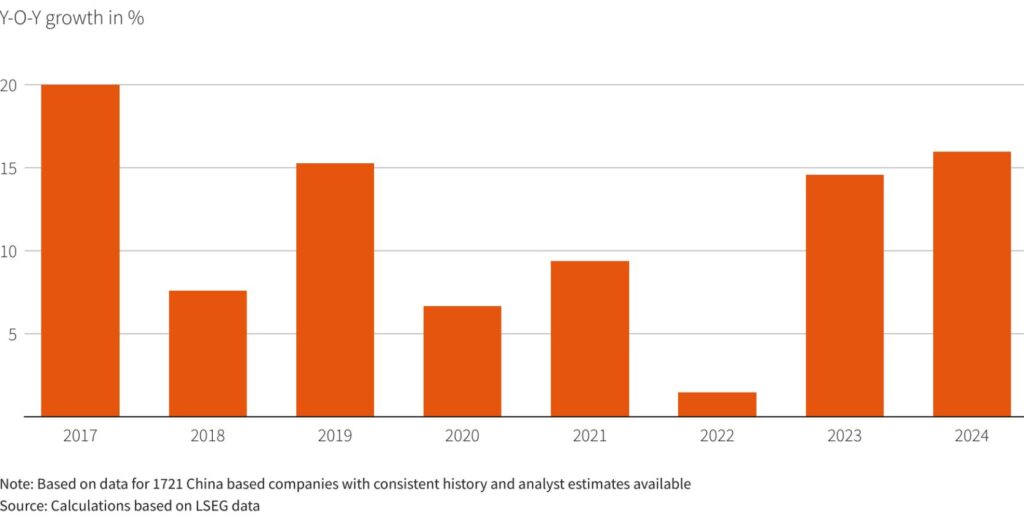

Based on experts’ predictions for government efforts to support consumer demand and an underperforming property market, LSEG estimates for Chinese enterprises in 2024 indicated that they are on track for their greatest earnings expansion in seven years.

According to a Reuters’ research of 1,721 Chinese companies with a $500 million or more market valuation, their profits could increase by 16% in 2018—the largest increase since 20.9% in 2017.Based on the data, a smaller rise of 14.5% is anticipated in 2023.

“China’s post-COVID economic recovery has been fragile, but the problems are mainly cyclical,” said Minyue Liu, investment specialist for Asia and Greater China equities at BNP Paribas Asset Management.

In response to a downturn in the real estate industry, which contributes approximately 25% of China’s GDP, the government has increased expenditures, local governments’ infrastructure projects, and other housing initiatives.

“These measures could boost (earnings) growth and help asset prices recover in 2024,” Liu stated.

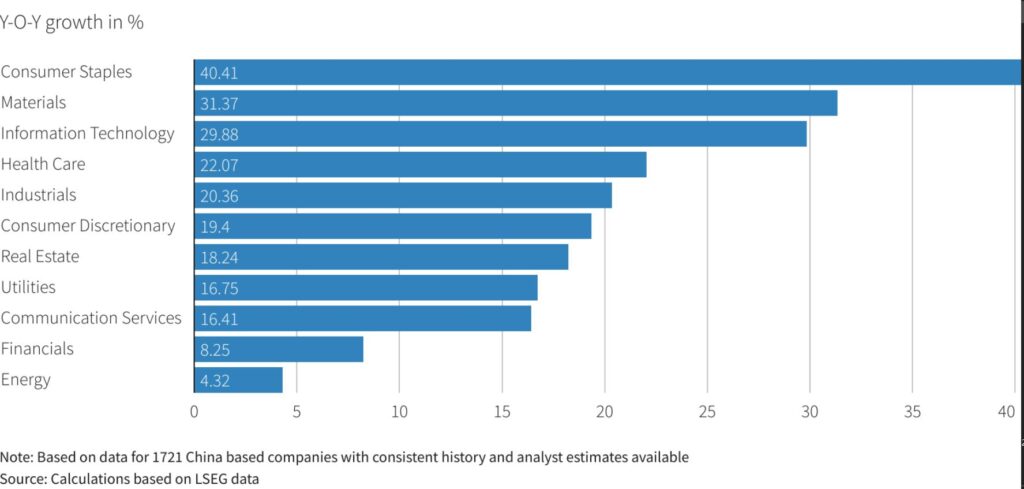

The consumer staples and software industries are expected to report 40% and 30% earnings growth, respectively, according to projections.

Roughly 20% growth is anticipated in each of the consumer discretionary and industrial sectors, and up to 18% growth in the real estate sector. The industries with the weakest growth are predicted to be banking and energy, with 8.2% and 4.3%, respectively.

It is heartening to see current initiatives for the real estate sector being more focused than just incremental finance support from banks as in the past, according to John Lau, portfolio manager for Asia Pacific and emerging market stocks at SEI.

According to Lau, investor confidence in the consumer and e-commerce sectors would also increase under such steady or growth-oriented government policies.

Net Income Growth Projections of Chinese Companies

An economic comeback is anticipated for next year, based on certain macro indicators that have already begun to improve.

The nation’s GDP beat forecasts in the third quarter! And imports are starting to rise once more, indicating strong domestic demand. Retail sales, fuel use, and truck traffic on national highways have all grown.

Alec Jin, who is investment director of Asian stocks at abrdn. He stated that “macro indicators are already flashing some encouraging signals that China’s targeted policy support this year may be starting to bear fruit.”

He predicted that both the domestic recovery and consumer spending will pick up momentum in the upcoming year.

Sectorwise Breakdown of Profit Growth in 2024

Track the latest trends of GIFT Nifty Chart here!

Risks Anticipated

Analysts are concerned about the possibility of a replay of 2023, which began with high expectations for a post-pandemic recovery but swiftly collapsed, resulting in a decline in stock prices and investment outflows.

This year, the Shanghai Composite index (.SSEC) has decreased by almost 2%. Through the Stock Connect program, international investors withdrew $21.2 billion from Chinese stocks between April and October.

“The main domestic risk would be that the expected stabilization and recovery in real estate could take a longer time to materialize than what the market is currently expecting,” Jin stated.

Head of HSBC Asset Management’s China and Specialized Asia strategy Caroline Yu Maurer stated that the continued geopolitical tensions between the United States and China, particularly about export restrictions, increase the risks and may have an impact on the development of certain industries like technology and artificial intelligence.

However, Maurer highlights how inexpensive Chinese stocks are and suggests that the dangers may already be taken into account.